Our Investment in Uni

This article was initially published on SeedToScale

We are excited to announce our latest seed round in the stellar team at Uni.

Today, less than 2.5% of the Indian population has a credit card. In a market dominated by incumbent banks, long-winded KYC processes and hidden fees further aggravate this problem. Even at this abysmal penetration, India sees over $100 billion in annual credit-card spends.

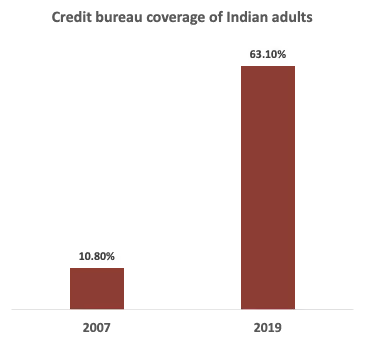

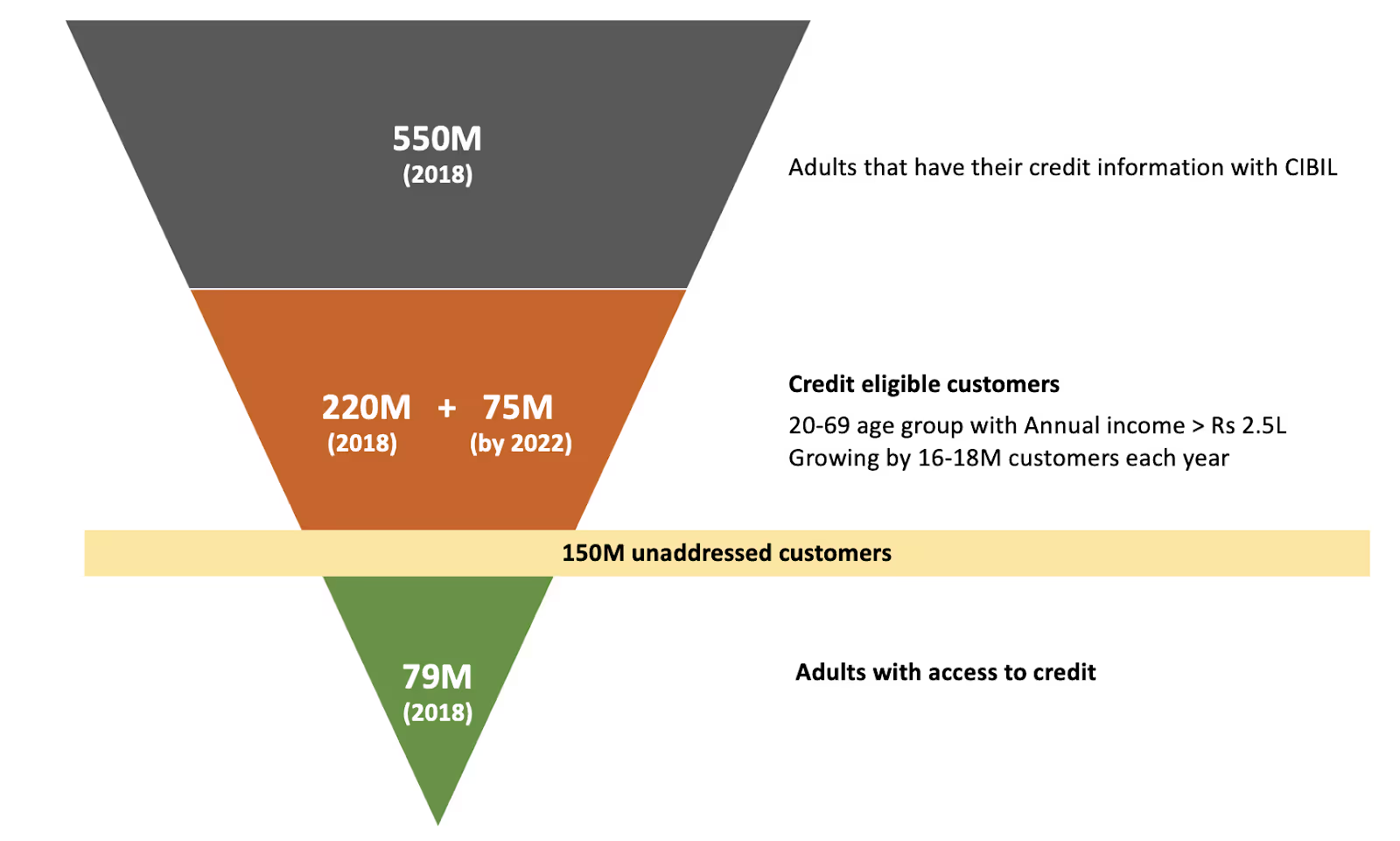

Retail credit bureau coverage in India has made significant strides over the last decade, examining over 300M new adults’ credit information.

This has laid a solid foundation to build consumer solutions at scale. However, we estimate that only 35% of credit-eligible adults get access to credit today.

We have been on the lookout for exceptional teams passionate about unlocking access to new-age credit for India. Nitin and his team provide this in spades and as we spent time with them, we grew ever more confident about their ability to realize their vision.

Nitin is a veteran entrepreneur, having co-founded PayU and headed Ola Financial Services in the past. With co-founders Prateek and Laxmi bringing their rich experience in financial services, we believe this team is best-suited to create something truly remarkable from this opportunity.

We are delighted to support Uni as their journey unfolds and welcome them to the Accel Family!

From L to R: Nitin Gupta (Uni founder), Prayank Swaroop (Accel), Siddarth Jain (Accel), Swapnil Basak (Accel)

Great companies aren't built alone.

Subscribe for tools, learnings, and updates from the Accel community.